SpecialFocus

efore anyone had even heard of COVID, IAPD members were grappling with a shortage of available means of transporting their materials. At the time, the IAPD Supply Chain Efficiencies Task Force had just formed to identify ways in which to improve the efficiency of the performance plastics supply chain. However, they quickly realized that transportation was an issue: rates were increasing, capacity was decreasing and so the task force shifted their focus to finding ways in which IAPD members could adapt. They recognized that often IAPD members are not shipping “ideal freight,” so they developed these guidelines to offer some insight and guidance. Fast forward to today, and the issue has only compounded. However, the advice in this message is still helpful and, thus, we are sharing an updated version of the task force’s findings here.

The switch to an electronic logging device (ELD), reduced hours for drivers and driver shortages are causing disruptions and increased costs. The practice of logging driving time using paper and pencil are gone. Electronic tracking devices are now mandatory on all trucks, which are recording the time more accurately. In addition, many tasks such as loading/unloading freight and safety checks that have, in the past, not been included in the shift time are now being counted as part of their hours of service.

The result is that shipping companies are being more selective about what they ship and where they go, seeking to maximize the space for freight and shipping lanes. At times, entire regions of the country may be temporarily embargoed by the shipping companies. Considering that the northern portion of the United States experiences bad weather for part of the year, it wouldn’t be surprising for shipping companies to take that into account when determining the routes that they will serve. Additionally, freight companies are adding surcharges and accessorial fees based on the rules set forth in the carrier’s tariff to offset the capacity issues, most notably to over length and extreme length freight or misclassified freight.

While some sought relief by using inter-modal shipping (i.e., trains), the rail system also cannot keep up with demand. Plus, rail is known for unreliable shipping times.

Freight and transportation companies are working on solutions to this issue, including adding more drivers and equipment to keep up with the demand, but they are hampered by the workforce shortage facing many IAPD members and supply chain shortages themselves.

When a shipper ships multiple pallets and/or multiple oversized pallets, the carrier will look at how many actual feet the skids take up; this is called the carrier’s linear foot rule (varies by whatever limit is set forth in a particular carrier’s published tariff) which means that once the dimensions of the shipment (all of the loaded pallets) exceed certain parameters, the standard LTL quote based on the agreed upon discount may be invalid due to the linear foot rule.

The next part of that equation is the carrier’s cubic capacity limits — which is the linear feet of how much space the shipment takes up but also factoring in the total weight of the shipment and any unusable spaces beside or above the shipment (if pallets cannot be double-stacked) —which are taken into account by the literal cubic space including empty space the entire shipment occupies with the carrier figuring out the pounds per cubic foot of all of that space.

For example, consider one pallet of plastics sheets at 732 pounds with dimensions of 96″ x 49″ x 18″ = 14.94 lbs per cubic foot (pcf) = Actual Class 85. The carrier will make the height 96″, which means: 96″ x 49″ x 96″ = 2.8 (pcf / density) = Actual Class 250. This shipment will be rated at a much higher class before any Freight All Kinds (FAK) agreements would be applicable.

In the past, IAPD members have taken advantage of entering FAK agreements with specific carriers for lower rates, which often included exemptions from some of these accessorial fees. The recent changes to these accessorial fees — specifically the lowered over length limits — have meant that carriers are not willing to give any of their customers exemptions regardless of any FAK agreements that may be in place. Due to the scarcity of drivers in general, shipping companies can be more selective about what they transport and they may scale back on their work with performance plastics companies, favoring industries that have “good freight” instead.

Distributors:

- Do better sales and inventory forecasting for better planning and discuss with manufacturing partners.

- Do everything you can to order full truckloads and increase your inventory of stock material.

- Work with manufacturing partners to create a predictive shipping schedule.

- Dispersing the additional per truck fee over greater poundage (of freight on the truck).

- Build the added charges into the price of the materials.

- Talk to customers to find out what they’re doing with the materials; do they really need oversized materials? Can it be cut and shipped in smaller dimensions? If you can, trim the size of the sheets and skids, so it’s less than 4′ x 8′ to avoid surcharges.

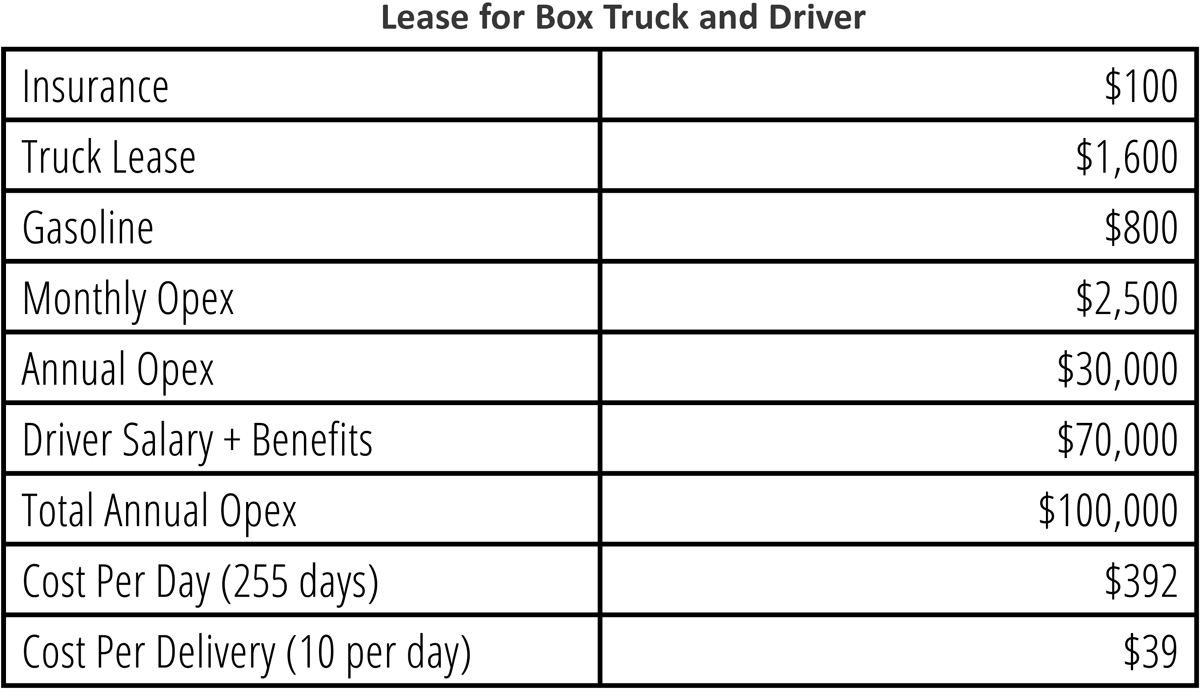

- Consider investing in trucks and drivers or contact with a local shipping company that will pick up orders from a manufacturer’s hub location.

Packaging

- Add plywood to the top and sides of pallets before adding the corner guards, so the pallets can be stacked.

- Build crates with slots for the materials and line with protective material; the crates would then be stackable — including pallets that may be attached to the walls to free up floor space.

- Include collapsible wheels on your pallets.

Manufacturers

- Swing capacity based on LTL availability (take advantage of available capacity).

- Offer a cafeteria plan for shipping: one price for 7-day shipping, an additional fee for faster turnaround, drop ship or custom orders.

- No breaking of pallets.

- Renegotiate shipping fees with major carriers.

- Only ship to a distribution center, rather than third party locations.

- Trim the size of the sheets and skids so it’s less than 4′ x 8′ to avoid the additional charge.

- Only ship full truckloads and stop 2-3 times in a region.

- Have consolidation days for distributors, so all shipments are delivered together.

- Offer a freight credit to distributors who pick up orders in their own trucks.

Packaging

- Add plywood to the top and sides of pallets before adding the corner guards, so the pallets can be stacked.

- Build crates with slots for the materials and line with protective material; the crates would then be stackable — including pallets that may be attached to the walls to free up floor space.

- Include collapsible wheels on your pallets.