Receivables over 30 days were 1.7 percent, down from 1.8 percent the previous month and down from 2.1 percent in the same period in 2021. Charge-offs were 0.09 percent, down from 0.17 percent the previous month and down from 0.55 percent in the year-earlier period. Credit approvals totaled 78.2 percent, down from 78.4 percent in January. Total headcount for equipment finance companies was down 12.2 percent year-over-year, a decrease due to significant downsizing at an MLFI reporting company. Separately, the Equipment Leasing & Finance Foundation’s Monthly Confidence Index (MCI-EFI) in March is 58.2, a decrease from 61.8 in February.

ELFA President and CEO Ralph Petta said, “New business volume at MLFI 25 companies has grown modestly in 2022, as it typically does in the early months. What is eye-catching, however, is the extremely high credit quality reported by respondents. Geopolitical unrest, increasing interest rates, inflation and continuing supply disruptions all pose headwinds that bear monitoring. But equipment finance companies always find ways to stay relevant, resilient and reliable in helping American businesses acquire the assets they need to thrive.” www.elfaonline.org/knowledge-hub/mlfi-25-monthly-leasing-and-finance-index.

Silver is the most used inorganic antimicrobial additive. It is non-toxic, environmentally friendly, sustainable and has excellent safety. Silver ion is the active ingredient in silver antimicrobials. It is permanent and has high thermal stability. Silver can be incorporated into a wide variety of polymer and textile industries without changing the product aesthetics. There is a higher demand for inorganic antimicrobial additives mainly due to their non-volatile nature, high thermal stability and widespread applications. Inorganic antimicrobial additives are widely used in the healthcare, packaging and construction industries.

The medical and healthcare segment is estimated to be the largest application of the antimicrobial plastics market during the forecast period owing to the heightened demand for antimicrobial plastics driven by growing consumer awareness about personal hygiene and health-related issues. Due to COVID-19 at the beginning of 2020, the awareness among manufacturers and consumers for the usage of antimicrobial plastics has increased. This has resulted in more demand for these plastics in different applications industries, specifically the medical and healthcare industry. www.researchandmarkets.com/reports/5178020/antimicrobial-plastics-market-by-additive.

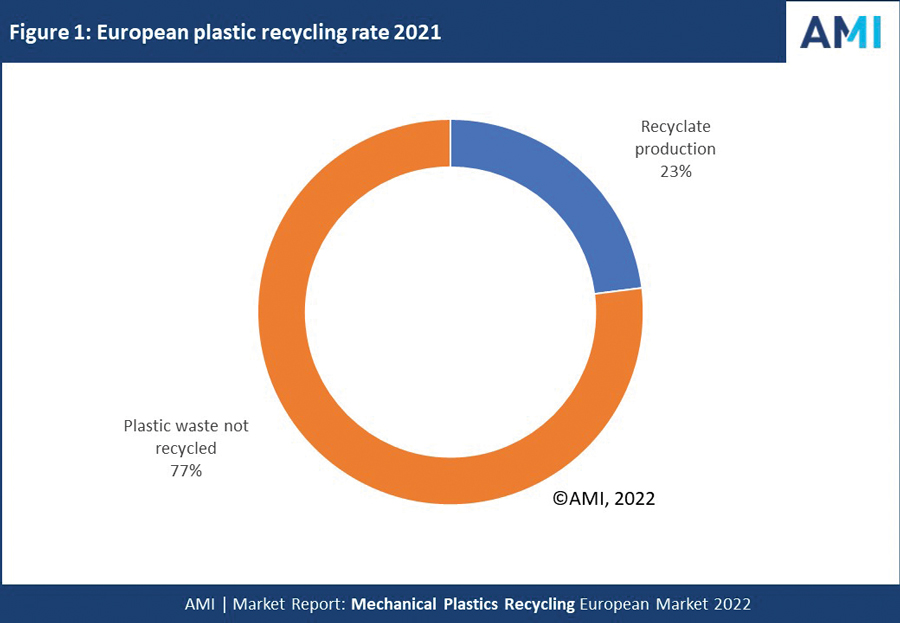

Although the volume of commodity plastic entering the waste stream on a yearly basis is extremely large, estimated by AMI Consulting as 35.6 million tons in 2021, feedstock availability should not be taken for granted. Much of this waste is currently uncollected for recycling or lost at the sorting stage. Feedstock is therefore a finite resource, characterized by bail price fluctuations and variable quality and supply.

Plastics recyclate production was 8.2 million tons in 2021 and is forecast to grow at a rate of 5.6 percent per year to 2030. To put this figure into context, one must review it in tandem with the 35.6 million tons of commodity plastic entered the waste stream in 2021. This implies that Europe achieved an overall plastic recycling rate of 23.1 percent.

The coronavirus pandemic has had an impact on both the volume of waste being collected for recycling as well as simultaneously reducing the demand for recyclate, as factories close or reduce production. However, to date it has not seemed to have had a long-lasting effect, as the industry has in general bounced back.

AMI sees within the 2030 timeframe of its report, additional absorption of recyclate volumes into applications that to date absorb negligible levels, particularly in Western Europe. Uses for recyclate are becoming more diverse, and the ability to absorb recyclate into higher value applications is also increasing, creating added value for the industry. AMI expects the commercialised and scaled production of food grade rPP and rPS within the timescale of the report, creating new closed loop systems, as we already see for rPET.

AMI’s report quantifies the market for mechanical recycling, analyzing the supply and demand balance, along with an evaluation of current production by country. The report also looks at feedstock supply and the waste plastics value chain. A detailed review of the end use applications for recyclate is given, with an examination of potential future absorption.

The report, Mechanical Plastics Recycling – European Market 2022 is relevant to all those involved in the plastics industry value chain, from resin producer through to brand owners/end users of plastic products. The report delivers a comprehensive quantitative assessment of the current industry situation and forecasts where this critical aspect of the plastics industry will go in the future. www.ami.ltd/recyclingandsustainability.