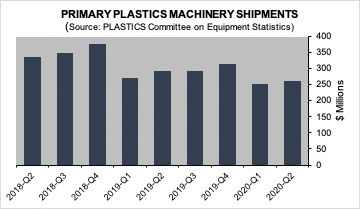

Second quarter shipments of primary plastics machinery (injection molding and extrusion) in North America increased, according to statistics compiled and reported by the Plastics Industry Association’s Committee on Equipment Statistics (CES). The preliminary estimate of shipments value from reporting companies totaled US$263.4 million, a 4 percent increase over the first quarter of 2020, when shipments decreased 19.8 percent from the previous quarter. The percentage decrease in the first quarter of this year was 10.7 percent lower than during the same period last year.

The value of shipments of single- and twin-screw extruders fell 35.8 percent and 30.1 percent, respectively, in the second quarter. Shipments of injection molding equipment were up 11.4 percent from the first quarter, but down 8.5 percent from the second quarter of last year. “Although primary plastics machinery shipments are still lower than the previous quarters, the second quarter uptick is consistent with gradual improvement in the U.S. economy,” according to PLASTICS Chief Economist Perc Pineda, PhD.

The CES also conducts a quarterly survey of plastics machinery suppliers asking about present market conditions and expectations for the future. Forty percent of respondents expect conditions to either improve or hold steady in the third quarter — higher than the 18.5 percent who felt similarly in the first quarter. As for the next 12 months, 24 percent of respondents expect market conditions to be steady or better, slightly above the 22.6 percent who felt similarly in the previous quarterly survey. “It was projected that the plastics industry will experience the worst impact of the coronavirus disruption in the second quarter. However, not all sectors of the economy closed,” said Pineda. Many businesses remained open to ensure uninterrupted supply for products in the healthcare sector, for example. There are also other segments in U.S. manufacturing — particularly in nondurable essential goods — that use plastic materials or products that continued operations during the lockdowns. “Plastics equipment suppliers and converters serving essential consumer end-markets have a reason to be optimistic as economic conditions continue to improve.”

Plastics machinery exports in the second quarter totaled US$289 million, a 21 percent drop from the previous one. Imports rose by 15 percent to US$649.5 million, resulting in a trade deficit of US$360.5 million, 9 percent lower than in the second quarter last year. Canada and Mexico remain the top export markets for U.S. equipment suppliers. Combined exports to the USMCA trade partners totaled US$134.5 million, representing 46.5 percent of total U.S. plastics machinery exports in the second quarter. www.plasticsindustry.org/supply-chain/equipment-suppliers-moldmakers/committee-equipment-statistics-ces.

U.S. processing of recovered plastic film, bags and wraps grew 10 percent between 2017 and 2018, and collection of clear polyethylene film for recycling jumped 20 percent according to a report released by the American Chemistry Council and produced by More Recycling. The amount of film reported as recycled by U.S. and Canadian processors increased for the sixth consecutive year and reached its highest mark yet, with 69 percent of the total amount collected and processed in the United States or Canada and the remainder being exported. U.S. recycling of predominantly polyethylene film held steady, dipping 0.5 percent, or 4.7 million pounds, for the year. A minimum of 1 billion pounds of plastic film and bags were recovered in 2018. The 2018 National Post-Consumer Plastic Bag & Film Recycling Report includes recovery and processing of post-consumer and post-commercial bags and film. Most of the post-consumer film is collected nationally, at large grocery and retail stores. In order to keep the material clean and dry for processing, plastic film requires a different collection stream from rigid plastics, such as bottles and containers, which are often collected curbside.

ACC also released the 2018 National Post-Consumer Non-Bottle Rigid Plastic Recycling Report, which showed that domestic reclamation of non-bottle rigid plastics grew 4 percent, with the most significant increase coming from bale commodities that were collected curbside or other commingled collection streams and then further segregated by resin. Since 2010, total non-bottle rigid plastic recycling has increased more than 50 percent with domestic purchases more than doubling during the same period. Overall, at least 1.3 billion pounds post-consumer non-bottle ridged plastic was collected for recycling in 2018, a 3.5 percent drop from 2017. www.americanchemistry.com.

New business volume grew 10.5 percent in the equipment finance industry in 2019, according to the 2020 Survey of Equipment Finance Activity (SEFA) released by the Equipment Leasing and Finance Association (ELFA). The rise in new business volume marked the 10th consecutive year that businesses increased their spending on capital equipment. The 2020 SEFA covers key statistical, financial and operations information for the US$900 billion equipment finance industry, based on a comprehensive survey of 100 ELFA member companies. While the report does not reveal the impact of the COVID-19 pandemic on the equipment finance industry, as it focuses on data from fiscal year 2019, it provides insight into multiple aspects of the industry, as well as the state of the industry preceding the pandemic.

The 10.5 percent new business growth in 2019 was stronger than the 4.4 percent increase achieved in 2018, and considerably stronger than the growth of the nation’s gross domestic product (GDP), reported at 2.3 percent for 2019 by the U.S. Department of Commerce. From an asset perspective, the top-five most-financed equipment types were transportation, IT and related technology services, construction, agricultural and industrial/manufacturing. The top five end-user industries representing the largest share of new business volume were services, agriculture, wholesale/retail, industrial and manufacturing, as well as transportation. Employment levels grew slightly, by 1.2 percent.

ELFA also released a companion report to the 2020 SEFA called the 2020 Small-Ticket Survey of Equipment Finance Activity. The report, which focuses on small-ticket and micro-ticket equipment transactions among the SEFA respondents, found that new business volume in the small-ticket space grew by 5.8 percent in 2019.

“We are pleased to share the results of the 2020 Survey of Equipment Finance Activity,” said ELFA President and CEO Ralph Petta. “The world is a very different place today in the midst of the COVID-19 pandemic than it was in 2019. However, the 2019 statistics included in this report provide valuable industry benchmark data. The 2020 SEFA, the Interactive SEFA Dashboard and the personalized MySEFA data visualization tool are all designed to help users make more informed, data-driven decisions. We thank all the ELFA member respondents, without whom this leading industry data source would not be possible.” www.elfaonline.org.